Vehicle depreciation calculator taxes

Alternatively if you use the actual cost method you may take deductions for. To calculate the depreciation of your car you can use two different types of formulas.

2020 Section 179 Commercial Vehicle Tax Deduction

This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles.

. The depreciation is calculated by applying the vehicles depreciation rate average high or low and. Use this IRC 168 k federal income tax benefit estimator to see what tax benefits your business could potentially qualify for in 2021. This limit is reduced by the amount by which the cost of.

The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business. With this handy calculator you can calculate the depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS. Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime.

Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. A P 1 - R100 n. Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade.

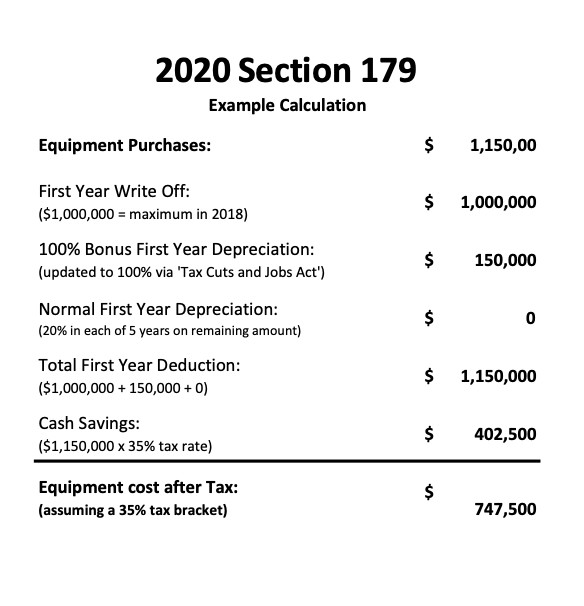

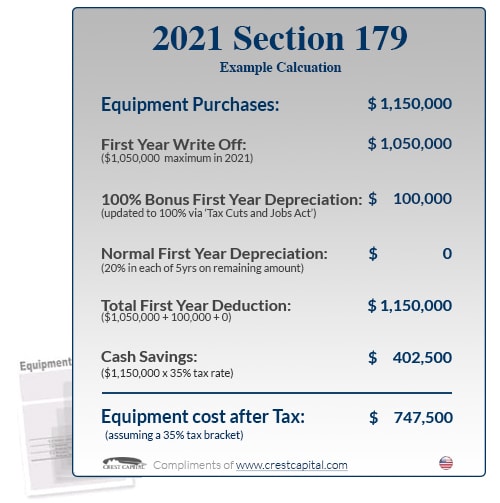

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. According to the general rule you calculate depreciation over a six-year span as follows. Section 179 deduction dollar limits.

It can be used for the 201314 to 202122 income years. Car Depreciation Calculator. If the business use on your vehicle is under 50 youre required to use the straight-line depreciation method SLD instead.

Depreciation of most cars based on ATO estimates of useful life is. The recovery period of property is the number of years over which you recover its cost or other basis. Simply enter in the purchase price of your equipment andor software and let the calculator take care of the rest.

Where A is the value of the car after n years D is the depreciation amount P is the purchase. R21 40635 x 100 114 R18 77750 30 Sept 201 30 April 202 7 months. SLD is easy to calculate because it simply takes the.

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Years 4 and 5 1152. Prime Cost Method for Calculating Car Depreciation Cost of Running the Car x Days you owned 365 x.

The Car Depreciation Calculator uses the following formulae. 2nd Tax Year 16400. For new or used passenger automobiles eligible for bonus depreciation in 2021 the first-year.

We base our estimate on the first 3 year. The rules governing depreciation of vehicles can be. 3rd Tax Year 9800.

We will even custom tailor the results based upon just a few of. Year 1 20 of the cost. Determine how your vehicles value will change over the time you own it using this tool.

It is determined based on the depreciation system GDS or ADS used. Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. Each Succeeding Year 5860.

D P - A. Heres an easy to use calculator that will help you estimate your tax savings. Bought for R21 40635 incl VAT therefore use the VAT exclusive amount and then calculate the depreciation.

Depreciation Rate Formula Examples How To Calculate

Depreciation Of Vehicles Atotaxrates Info

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Free Macrs Depreciation Calculator For Excel

Depreciation Rate Formula Examples How To Calculate

Car Depreciation Rate And Idv Calculator Mintwise

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Depreciation Of Vehicles Atotaxrates Info

Section 179 Tax Deduction Vehicles List Bell Ford

Macrs Depreciation Calculator Irs Publication 946

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Car Depreciation Calculator

Download Depreciation Calculator Excel Template Exceldatapro

How To Calculate Depreciation Expense For Business

Depreciation Calculator Depreciation Of An Asset Car Property

Download Depreciation Calculator Excel Template Exceldatapro